June 2024 top M&A deals in emerging markets by region

By EMIS DealWatch

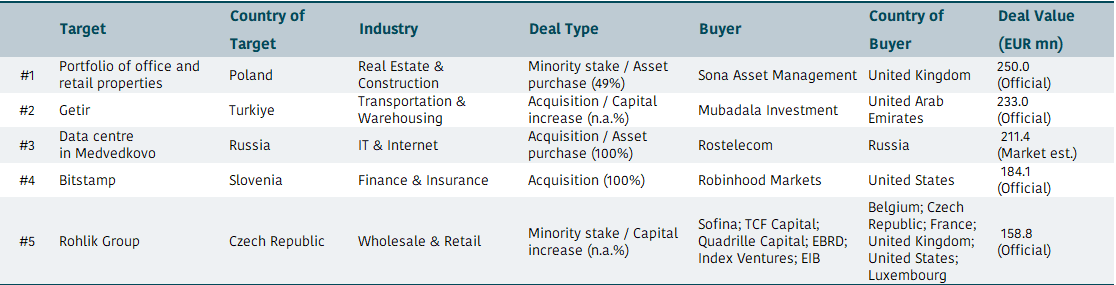

Emerging Europe

Czech real estate investment firm CPI Property Group announced the sale of a 49% stake in a portfolio of eleven office and two retail properties in Poland to funds managed by Sona Asset Management for EUR 250mn. The properties, having combined gross asset value of around EUR 1bn, include assets in Warsaw, Elbląg, and Lublin. After the sale, CPIPG will retain full operational control and continue to consolidate Vulcanion, the holding company for these properties. The transaction aligns with CPIPG's strategy to reduce leverage.

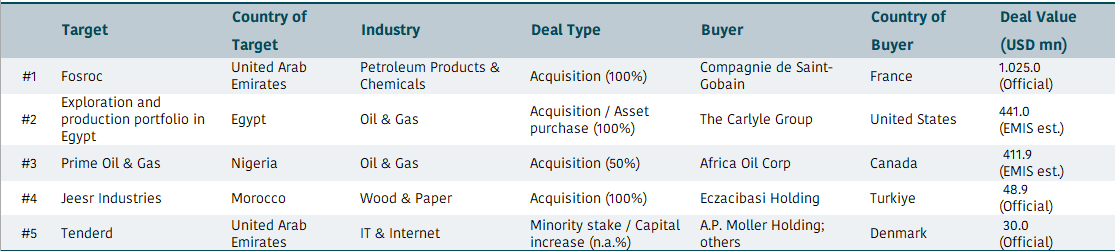

Middle East & Africa

French building material manufacturer Saint-Gobain inked a deal to acquire Dubai-based construction chemicals Fosroc from JMH International for an enterprise value of EUR 960mn (USD 1.0bn). This acquisition is a strategic move to enhance Saint-Gobain's global presence in construction chemicals, leading to combined sales of EUR 6.2bn across 73 countries.

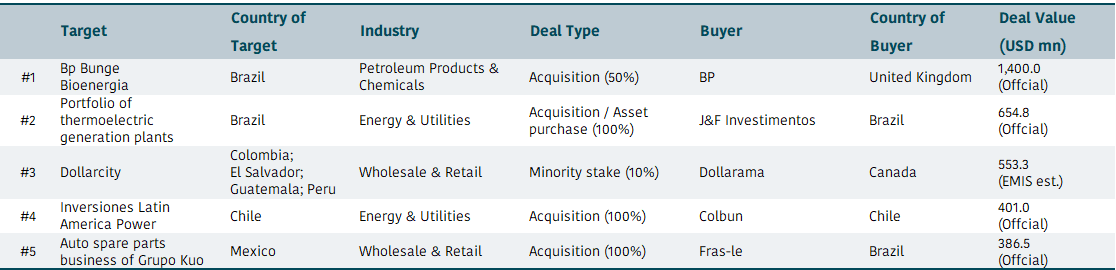

Latin America and the Caribbean

British energy group BP to acquire Bunge's 50% stake in their joint venture, bp Bunge Bioenergia, making BP the sole owner of this Brazilian biofuels company. The enterprise value of the stake is USD 1.4bn. After completion, BP will have the capacity to produce around 50,000 barrels a day of ethanol equivalent from sugarcane through 11 agro-industrial units across five Brazilian states.

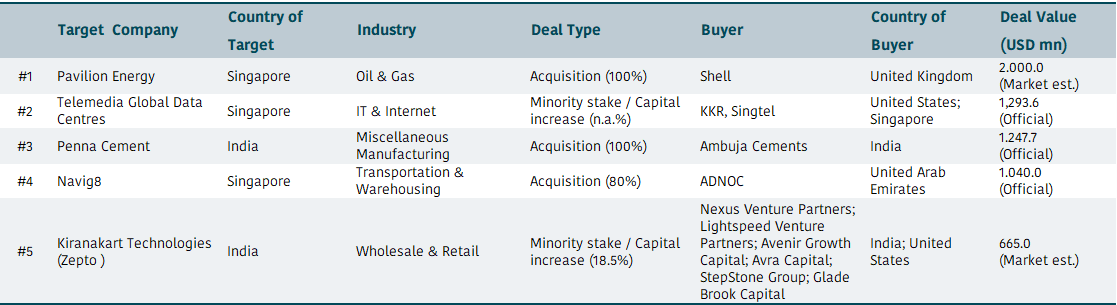

Emerging Asia

British oil and gas giant Shell announced it will acquire Singaporean liquefied natural gas company Pavilion Energy from sovereign wealth fund Temasek Holding for an undisclosed amount. The transaction could exceed USD 2bn, according to earlier media reports. Pavilion Energy is a global energy business with LNG trading, shipping, natural gas supply and marketing activities in Asia and Europe and a contracted supply volume of approximately 6.5 mtpa.

Are you interested in M&A intelligence? Request a demo of our platform here